Insurance has been a key player in the global market for decades, but in recent years, there has been a buzz around Insurtech. Startups all over the world have attempted to disrupt the industry’s $10 trillion market through technology, where established players have struggled to keep up. While many have argued that insurance companies are ripe for disruption, there is more to the situation than meets the eye.

Source: Canva — Magic Media Editor — The Future of Insurtech

While there has certainly been disruption in insurance in the past decade, there are still many hard problems to solve in the industry, and incumbents have proven to be more resilient than many initially thought

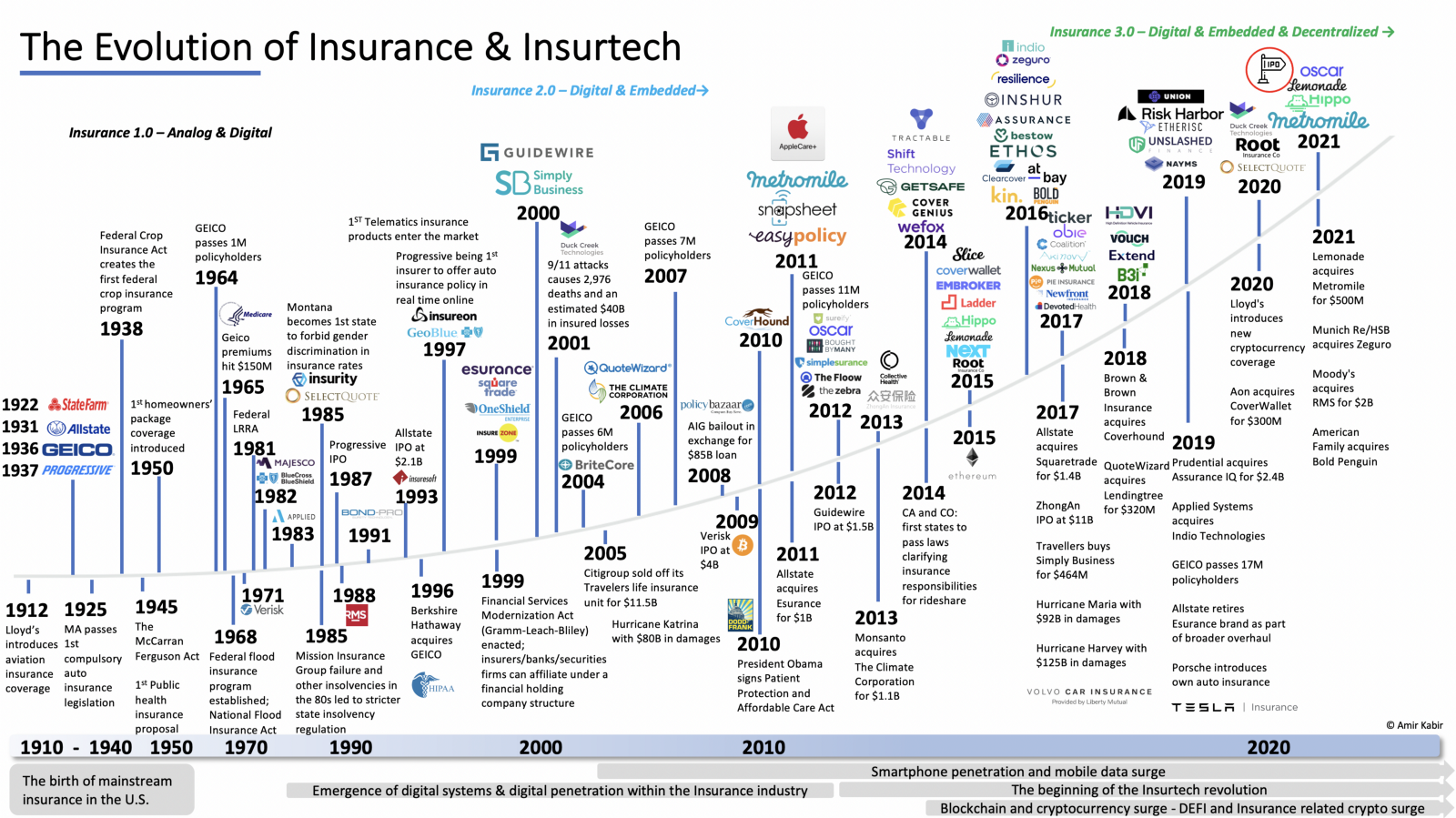

As discussed in Part I, I wrote about the industry’s progress over the past century and the key milestones that led to the rise of Insurtech. However, I also highlighted the fact that established players do not receive enough credit for their long-standing success in the industry and are unlikely to be replaced by any Insurtech anytime soon.

Source: Amir Kabir — The Evolution of Insurance & Insurtech (Updated)

The rise of Insurtech can partially be attributed to traditional insurance companies’ lack of focus on customer experience. Historically, these companies have classified their clients as “policyholders” instead of “customers”, demonstrating a disregard for their needs and satisfaction. The first wave of Insurtech startups aimed to improve the customer experience by focusing on user-friendly interfaces, advanced data sources, and digital solutions. While these improvements were significant and a great start, there is still a lot of room for growth, particularly in the specialty insurance sector.

Lessons derived from the first wave of Insurtech’s

It’s important to note that the first wave of Insurtech did not completely revolutionize the insurance industry, but rather made incremental advancements towards better serving customers.

However, Insurtech v1.0 companies successfully navigated the intricate task of convincing incumbents, service providers, consumers, regulators, and the broader financial markets that digitization of insurance is inevitable.

Their mission was to underscore the imperative inclusion of advanced technologies in the future of insurance while outlining a viable path for venture backable companies. Despite this, the performance of few Insurtech v1.0 ventures, assessed through exit metrics, might be perceived as underwhelming by the insurance or venture community.

Source: Amir Kabir — Insurtech v1.0 <> Insurtech v2.0 (Updated)

While Insurtech has made strides in the insurance industry, there is still much more to accomplish, and incumbents will continue to play a critical role in the industry’s future. As startups work to improve the customer experience, integrate insurance into everyday life, and solve the industry’s hard problems, the insurance industry will continue to evolve and adapt to meet the needs of its customers.

Revolutionizing insurance isn’t akin to a moon landing; small changes can make a big enough impact, but only if the fundamentals also align.

Moreover, a major learning is that there are no quick fixes that allow startups to overhaul traditional insurers. Technology will not replace any of the fundamental insurance basics to be successful in insurance. Insurtech is definitely not a top line industry, but a bottom line industry where loss ratio plays a very important role. Obtaining risk capacity has also become increasingly restricted in recent years and is likely to remain a challenge for many Insurtechs that rely on digital technology for distribution in the foreseeable future. Now more than ever, it is essential to possess a profound understanding of underwriting fundamentals while intimately grasping the nature of the insured risk.

Furthermore, Insurtech’s leveraging digital technology for distribution and product innovation require more capital commitment compared to those focusing on improving business efficiency, claims management, or data and analytics.

Navigating the valuation challenge and economics in the ever-evolving Insurtech landscape

When the Insurtech wave began in the early 2010s, the market was still figuring out how to value these innovative companies. Many of these Insurtechs, which focused on product and distribution, started mostly as MGAs (some eventually transitioned to or actually started as full-stack carriers) and had different economics than traditional insurance carriers.

Investors were generous with their valuations, basing them on growth metrics, potential, and the perceived quality and differentiation of the business model. Mostly, they relied on EV/GWP as a proxy for EV/Revenue, which includes growth potential. While the sector has several characteristics like subscription software models, GWP was looked at as (SaaS) revenue, which was/is not entirely accurate. Unlike traditional software companies, Insurtechs face inherent loss volatility and intense competition, resulting in lower gross margins. And while many Insurtechs boast impressive growth rates, they often have negative net income even at scale, making it difficult to value them in the same way.

The last year the public markets were initially seduced by the early Insurtechs’ growth stories, but as their performance has underperformed the broader market, these valuations have been questioned and challenged significantly. Even when comparing public companies within the sector, it’s clear that a top-line valuation metric like EV/GWP/Revenue is not enough to accurately assess the differences in quality and value of the business, customers, policies, and losses.

For early stage Insurtechs it is important to firmly understand the market they are serving and the underlying value per policy sold over the long run. For instance, Insurtechs operating in auto/home/renter/pets have faced and will face more scrutiny than Insurtechs operating in the specialty and commercial insurance market. Given the tech-enabled insurance characteristics an EV/GWP is an OK valuation methodology to begin with, however can ultimately not justify the full potential and outcome of an early Insurtech.

So, what’s next for insurance and Insurtech in the coming years? Where are the opportunities for growth and innovation in this field?

Embedded Insurance — Transforming the purchase of insurance and addressing critical protection gaps

Among the emerging trends on the financial services horizon, embedded finance may end up having the biggest impact on the industry’s makeup and infrastructure. Embedded insurance shares similarities with embedded finance, exhibiting comparable patterns. Generally, embedded insurance is categorized as solutions where a non-insurance entity distributes insurance products, either through APIs or a virtualized approach.

As the industry progresses into a more digital landscape, Insurtech startups can capitalize on the chance to integrate insurance seamlessly into relationships or purchase flows that don’t initially involve the need for insurance. The key lies in capturing the customer’s attention and trust, as those who successfully do so will have the opportunity to offer insurance or insurance-like products.

Embedded insurance is nothing new

Embedded insurance has been around for a quite some time now, just by a different name: affinity sales. Affinity insurance solutions bundled alongside other so called “pull” products have been around for more than a decade. Yet, advancements in technology, data analytics, and broader access to real-time data have paved the way for the emergence of embedded products. According to DataHorizzon Research, the embedded insurance market size was valued at USD 63.1 Billion in 2022 and is expected to reach USD 482.8 Billion by 2032 with a CAGR of 22.6%.

In the past couple of years CoverGenius and BoltTech stand out as major players in the embedded insurance sector, providing an extensive range of over a thousand warranty and insurance products across diverse categories such as travel, retail, commerce, and the sharing economy. They operate through various channels and possess licenses or authorizations in over 50 countries. Interestingly enough both companies didn’t originate from Silicon Valley; CoverGenius started out of Australia while BoltTech has its roots in Asia.

Here are a few examples of where embedded insurance products have demonstrated noteworthy market momentum

Extended warranties or product protections are a great example of an embedded insurance play, and several companies emerged throughout the years. In fact, the U.S. extended warranty market is expected to reach $59.52 billion by 2028.

One important milestone in history is The Magnuson-Moss Warranty Act, which congress passed in 1975 and which basically is the federal law that governs consumer product warranties. Important to note is that the law does not require all products sold to come with a warranty, however those that do must have clear, fair, and enforceable ones.

One of my initial investments ventured into this arena, specifically with Simplesurance, a European-based company out of Germany. Squaretrade and Asurion were pioneers in this field, with Squaretrade eventually being acquired by Allstate. Other startups making waves today include Extend, which is experiencing rapid growth, as well as Clyde, which was recenlty acquired by Cover Genius and Mulberry, which recently launched a zero deductible suscription plan.

Apple, undoubtedly one of the most significant and well-known players in the extended warranty space, has managed to generate a staggering estimated $8.5 billion in revenue. This demonstrates the immense potential within the realm of embedded products like warranties and insurance. What sets Apple apart is their mastery of integration, seamlessly enhancing the customer experience.

Another example is travel insurance, which is probably one of the oldest forms of embedded insurance that people know of or have taken advantage of. The global travel insurance market was valued at $14.2 billion in 2021, and is projected to reach $124.8 billion by 2031, growing at a CAGR of 24.7% from 2022 to 2031. Historically, traditional travel insurance has remained relatively static in its offerings. Nevertheless, the landscape is evolving, welcoming new entrants seeking to transform and modernize conventional insurance through a more sophisticated approach, leveraging advanced technologies such as satellite imagery and emerging data sources, including historical climate information as well as individualized customer data. This forward-thinking approach is ushering in a new era where travel or travel adjecent insurance is becoming more dynamic and personalized, while comprehensive data enables a more refined method in underwriting, allowing for a deeper and more precise evaluation of risks. Startup such as Sensible are innovating within this sector. As with other types of insurance, travel insurance is also regulated differently in each state. Here is some more information about the model law defining regulatory structure related to travel insurance and covers market regulation, premium tax, rate regulation, and enforcement.

Within the automotive and mobility industry, the concept of embedded insurance probably shows the greatest potential. However, navigating this path is anticipated to present challenges and hurdles rather than a smooth journey, as regulatory requirements must be carefully managed. Tesla and GM’s initiatives to offer insurance tied to driving behavior signal a significant shift in the automotive insurance landscape. They not only enable drivers to personalize their insurance premiums based on their actual driving habits but also offer incentives for safer practices. Tesla’s approach of assessing a driver’s safety score at the end of each month and subsequently adjusting the premium aligns with the embedded insurance concept, enhancing the synergy between the vehicle, its usage, and the insurance coverage. Furthermore, the expanding landscape of the sharing economy and the advancement of autonomous or driverless vehicles present an extended scope for the implementation and utilization of embedded insurance. One of my initial investments, Inshur, specializes in the commercial auto sector, delivering embedded on-demand insurance solutions throughout the United States and Europe. Through its strategic alliance with Uber, Inshur employs innovative processing of proprietary data and utilizes embedded technology in its underwriting processes.

I firmly believe that we are merely at the outset of what appears to be a pivotal moment for embedded insurance. Despite the ever-evolving landscape, it’s worth noting that currently, a minor proportion of insurance sales occurs online, particularly in the United States —Direct Writing encompasses online, phone, mail, and various other channels. A substantial portion of insurance products still follows traditional offline channels, particularly within the broader commercial sector and the personal Property and Casualty (P&C) domain.

Source: McKinsey Global Insurance Pools

Nevertheless, it’s important to highlight that embedded insurance is currently most ideally matched with uncomplicated and easily comprehensible products. This is particularly true for situations where the customer can readily grasp the product and the claims process is more straightforward.

The initial phase of embedded insurance has illuminated a fundamental shift toward a more integrated role for insurance in our daily lives. As the realms of buying and selling continue their digital transformation, insurance is set to become an integral part of our interactions and transactions, even if insurance isn’t the primary driver. Companies that have successfully embedded themselves in the lives of consumers and gained their trust will seize the opportunity to seamlessly weave insurance products into their existing offerings.

Some fundamental questions to answer are:

- Value Chain Dynamics: Key questions include identifying the primary beneficiary in the value chain — whether it’s the distributor, incumbent, or embedded participant.

- Regulatory Scrutiny: An examination of how regulators will approach new insurance offerings, especially those delivered online or through mobile devices.

- Monopolistic Trends: Exploration of potential monopolistic bargaining power within distributors and whether the market can accommodate multiple embedded products.

Closing parts of the insurance protection gap

Source: The Geneva Association — The root causes of insurance protection gaps, main areas of relevance

There is also a huge protection gap between the amount of insurance that could have been purchased and the insurance that is actually bought, especially in the risk pools of natural catastrophe, mortality/life, and health care. The value of unprotected risk exposure has risen steadily in the past five years. According to the Swiss Re Institute’s research, the global protection gap is at USD 1.8 trillion in premium equivalent terms for 2022, a cumulative 20% increase on the comparable-terms USD 1.5 trillion estimate for 2018.

While embedded insurance will not fully mitigate the gap, it can act as a catalyst

Source: Swiss Re Institute — Economic Resilience

The largest protection gap are more related to natural catastrophes: for earthquakes its around $135B, for Flood it is around $50B, and for Storms it is around $37B. But what about healthcare and healthcare related costs — Fully half of Americans now carry medical debt, up from 46% in 2020. And what about mortality protection gap as another example that is more than $400B in the US alone. Commercial Insurance is another opportunity to highlight as well, where there is huge gap — Examples include traditional business Interruption risk and NDBI (Non-damage business interruption).

Speciality Insurance — The next frontier in digitizing business lines, embracing successful strategies from other sectors of insurance

The first wave of Insurtech’s focused on direct customer acquisition and utilizing several distribution options. However, the specialty insurance sector presents a different set of challenges, requiring a more sophisticated approach to distribution, underwriting, and servicing customers.

But, there is a silver lining. Startups looking to make their mark in the specialty insurance category can take advantage of the technology advancements made by others in the insurtech world. The lessons learned from the first wave of Insurtech’s can be applied to this new frontier, allowing startups to hit the ground running.

The specialty insurance sector is vast and diverse, but there are a few specific areas where opportunities are abundant. For example, as with most specialty lines of insurance, the underwriting and distribution processes can be overly complex and time-consuming, often relying heavily on manual navigation. This presents a prime opportunity for Insurtech’s to streamline these processes, making them more efficient and accessible to customers.

- New Products: The products available in specialty markets are largely outdated, having remained unchanged for decades and not adapted to the continuous socio-economic and technological developments. The access to extensive data and technological advancements enables the development of new products catering to customer needs.

- Underwriting: Efficiency and speed — The underwriting process for specialty insurance lines is often bogged down by manual efforts from both customers and agents, making it a time-consuming and cumbersome process. However, with advancements in technology and sophisticated data aggregation, there’s a major opportunity to streamline this process and bring efficiency and speed to the underwriting approach for specialty insurance. This approach has already been successful in other insurance lines, and it’s time for the specialty insurance sector to follow suit and modernize their underwriting process.

- Distribution: The distribution of specialty insurance products is largely dependent on agents and brokers, offering a unique opportunity for technology-driven platforms to support and enhance their workflow and risk assessment processes. This opens up the possibility for direct distribution while also allowing for an embedded approach, leading to faster and more efficient distribution. Despite the evolution of technology, the role of agents and brokers will persist and continue to play a crucial part in the distribution of specialty insurance products. By embracing sophisticated technology, they will further evolve and improve their processes, providing a better experience for customers.

Source: Amir Kabir — Some of AV8’s investment in the speciality insurance category

Here are some other speciality insurance categories that have exiting potential in the future:

Medical Malpractice — An ancient market that needs technological help

Medical malpractice can be dated back to the Mesopotamia time, where the concept of holding medical professionals accountable for deaths or injuries that could have reasonably been prevented. In todays world medical professionals including physicians, clinics, nurses etc. have to carry some sort for medical malpractice insurance that covers them for injury related to medical negligence, resulting in a patient needs to prove that substandard medical care resulted in an injury. Similar to other lines of insurance in the U.S. medical malpractice law has traditionally been under the authority of the individual states and not the federal government, in contrast to many other countries.

Evaluating and underwriting medical malpractice insurance is a highly manual process, requiring considerable time. Hospitals and doctors must complete a PDF application, submit it to an agent along with their resume, credentials, financial projections, etc. An underwriter then manually inputs most of this information into a rating table. The underwriting process commonly considers cost determinants and data such as the frequency of claims, the severity of claims, required coverage amounts, local regulations, and the geographical practice location. Typically, physicians wait around one week for a quote, home healthcare systems take 3–4 days, and hospitals usually face a 2–3 week turnaround time.

Medical malpractice insurance premiums are 1% of national health care costs (Congressional Budget Office)

Medical malpractice insurance premiums are the 3rd largest cost for physicians, after payroll and space costs

Innovative players in this field include Indigo and Now Insurance. Even major established companies like Berkshire Hathaway are actively involved in this sector. For instance, Berxi, a segment of Berkshire Hathaway Specialty Insurance, offers medical malpractice insurance through a direct channel.

NDBI — Catastrophic risk is the hardest risk of all for a business to protect itself against

NDBI, which stands for Non-damage Business Interruption, represents the next wave of innovative insurance solutions that have been in existence for a considerable period. However, the recent pandemic and subsequent shutdowns in various economies have significantly amplified interest in this area.

While traditional Business Interruption (BI) insurance is centered on covering actual physical damage and necessitates evidence linked to that damage, as typically outlined in the policy, NDBI deals with scenarios where there’s no physical damage. These scenarios might encompass business interruptions stemming from factors like political unrest, pandemics, cyber attacks, war, etc., situations that typically result in business interruptions. Most of these events lead to medium to long-term economic repercussions that demand a sophisticated insurance, risk transfer, and resilience solution.

While traditional BI relies on standard, tangible risk identification and assessment methods, NBDI necessitates an entirely different and sophisticated approach. Current NDBI products in the market are more tailored than mass market applicable. For instance Munich Re offers EQuIP (Earnings Quality Insurance Protection), a Non-Damage Business Interruption solution specifically designed for the Pharma industry. This specific solution provides a bespoke risk transfer solution for the Pharma industry covering regulatory related production shutdowns. AON on the other hand has been in the market since 2018 with a more broad NDBI product using data, analytics and parametric triggers to cover a broad range of businesses, including hotels, retailers, pharmaceutical firms and transportation companies.

Source: Swiss Re Institute

Startups building in that space for example are OTTRSK, using machine learning and leveraging insurance-linked securities (ILS) structures to connect this emerging risk class with capital market investors.

Agent/Broker Enablement Technology — Leveraging software to enhance customer service and foster business growth for agents and brokers

As explored in Part I, many Insurtech startups have played a pivotal role in shaping the insurance industry over the past decade. However, a prevailing belief, shared by many (including myself), was that the digitization of the insurance value chain would render traditional agents and brokers obsolete. To our surprise, this presumption couldn’t have been further from reality. In fact, it has become increasingly evident that even Insurtech startups from the past decade ultimately recognized that the potential for significant growth transcends direct distribution and relies on collaboration with traditional “offline” insurance agents.

Furthermore, when considering commercial and specialty insurance lines, agencies and brokerages play a crucial role in distribution. This, in part, stems from the fact that customers who purchase substantial insurance policies still value the human touch in the process. Many brokerages and agencies grapple with the immense challenge of managing a vast volume of data and cumbersome manual processes, which significantly hampers their efficiency and often results in missed business opportunities. On the flip side, the fundamental goal of agencies and brokerages is to thrive, offering top-notch insurance products, user-friendly UX/UI, and fostering seamless communication and servicing.

The “modern” agent and broker is expected to increasingly integrate a substantial array of technology and digital tools in the future. This integration will aid in their interactions with the end-insured and streamline the process of placing business with carriers.

While established companies like Vertafore and Applied Systems maintain a strong presence in the market, there has been an emergence of several startups in recent years addressing different aspects of the agency life cycle, including prospecting, sales, analytics, servicing, administration, and more. Nevertheless, it’s crucial to emphasize that for these startups to succeed in this market, I believe they must automate every facet of the business. This results in a broad product scope encompassing both customer-facing and internal sales and operational software. Given the extensive product development needed, the traditional approach would not prioritize building a platform initially due to the high R&D costs. However, when executed effectively, constructing a platform could offer a substantial advantage.

One of our investments at AV8 is Glow, which is exaclty taking the approach to automate every facet of the agency side, by building the next-generation digital insurance agency for SMBs in a large, growing market that is both fragmented and profitable. Their sophisticated approach to customer acquisition, data aggregation, underwriting, policy placement and servicing is transforming traditional offerings while creating unique value and customer centricity for mid-market SMBs.

In Part III of Insurtech and the opportunity in emerging markets, I will cover the opportunities in developing markets such as LATAM, Africa, Middle East. Whether you have valuable Insurtech insights or wish to be part of the conversation, feel free to reach out at amir@av8.vc or via Twitter at @AmirKabir99.

0 Comments