In the ever-evolving landscape of finance and technology, one industry has been making waves by addressing a longstanding issue: the accessibility of insurance in emerging markets. Among the drivers of economic growth and development in emerging countries, insurance is often overlooked in favor of flashier sectors like technology or infrastructure. In fact, though, insurance is a behind-the-scenes factor driving growth at all levels of society, from family life to massive infrastructure projects to technology development.

Source: Canva — Magic Media Editor — Insurtech future in emerging markets

Understanding the Challenge

Emerging markets, characterized by rapid economic growth and increasing urbanization, often face challenges in providing adequate insurance coverage to their populations. Factors such as regulatory barriers, lack of awareness, financial stability, and outdated distribution channels contribute to a significant gap in coverage.

The Power of Mobile Technology

One of the key drivers behind enabling insurance in emerging markets is the widespread adoption of mobile technology. In many emerging countries a large portion of the population owns smartphones, and Insurtech startups can capitalize on this connectivity to reach previously underserved communities.

Customized Solutions for Diverse Needs

Insurance in emerging markets is not a one-size-fits-all approach. Successful startups recognize the importance of offering customized solutions that cater to the unique needs of each market. Whether it’s micro-insurance for low-income households, weather-based insurance for farmers, or health insurance with flexible terms, Insurtech platforms have to tailor their offerings to address specific challenges faced by local communities.

Financial Inclusion Through Collaboration

Collaboration has been a key strategy for Insurtech startups looking to penetrate emerging markets. By partnering with financial institutions, NGO’s, mobile network providers etc. Insurtech’s can integrate insurance solutions with existing services, making them more accessible to a wider audience. These collaborations not only drive financial inclusion but also contribute to the overall economic resilience of the communities they serve.

Addressing Cultural Nuances

Cultural nuances play a crucial role in the success of Insurtech ventures in emerging markets. Successful startups invest time and resources in understanding local cultures and adapting their products accordingly. This approach builds trust among users and ensures that insurance solutions align with the values and expectations of the communities they serve.

Source: Amir Kabir — Market, Opportunities and Challenges in Emerging Markets

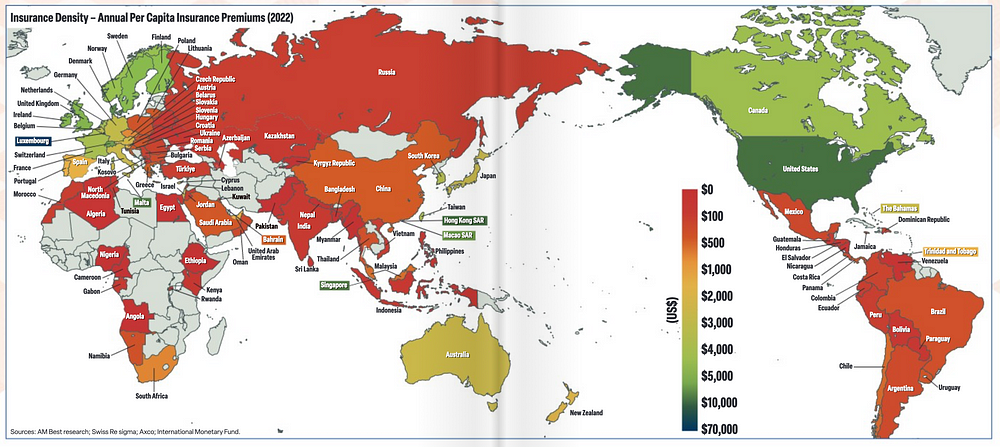

Insurance penetration serves as a metric for assessing the progress of the insurance sector in a country or region — It is computed by determining the ratio of total insurance premiums to the GDP (gross domestic product) in a specific year. Insurance density, coupled with insurance penetration, serves as a crucial metric for evaluating a country’s or region’s insurance sector development. Calculated as the ratio of premiums collected by insurance companies to the population, it is often expressed as the per capita premium in dollar terms.

The insurance density figures on all three continents are notably lower than the global average of $874.

Source: Best’s Review — January 2024 Edition

In terms of Insurtech maturity, Latin America is leading, while Africa and the Middle East are still in their very early stages of innovation, adoption, and disruption. Moreover, insurance and Insurtech penetration vary significantly among countries within each continent. As I highlighted in Part 1 of this series, the evolution of Insurtech in the United States unfolded gradually, spanning a period of more than two decades. Nevertheless, both Africa and the Middle East may have an advantage, as Insurtech’s in these regions can commence operations without the constraints of complex legacy systems. However, these endeavors encounter various other challenges that hinder their rapid scalability.

Latin America — A thriving and rapidly expanding insurance market, presenting significant opportunities for both incumbents and new entrants

Latin America (LATAM) emerges as a dynamic hub for innovation and entrepreneurship, a compelling reason for everyone to take a keen interest in the region’s startup landscape. With a staggering population of ~660 million individuals, almost twice that of the United States, it stands as a colossal force on the global stage. What’s truly striking is the remarkable ascent of the middle class in the region, experiencing a surge of over 50% in the past two decades, according to the OECD. The Latin American populace not only boasts significant numbers but also embodies a tech-savvy and youthful demographic, with a median age of 31 — seven years younger than both China and the United States. These insights underscore the region’s potential as a vibrant and influential player in the global landscape.

The weight of insurance on the LATAM economy accounts for ~3% of GDP, less than half the global average. In general, LATAM is an underdeveloped and underinsured market. In terms of life insurance, only 15% of Latin American adults who can afford such policies hold them, compared to 52% of U.S. adults. Similarly, less than 25% of vehicle fleets are insured in Latin America, whereas in the United States, this figure stands at 70%. What Latin America does have, however, is an over 80 percent digital adoption rate, which enables startups to expand the market.

Latin America has emerged as the region with the highest financial appeal for insurance companies, surpassing the global average that includes North America and Europe.

As per the 2023 Global Insurance Report from McKinsey & Company, the insurance market in LATAM is valued at $174 billion. Despite disparities, insurance penetration in LATAM is on an upward trajectory at a faster pace compared to other global regions.

Source: McKinsey — The Latin American Insurance Market

Over the past decade, the region has consistently outpaced other major insurance markets, boasting an impressive ~11% CAGR from 2018 to 2022 — outstripping North America, Asia, and Europe. Latin America’s insurance sector not only exhibits rapid growth but also proves highly lucrative, with a robust average Return on Equity (ROE) of 16.6% in 2022, surpassing global averages. Despite these promising figures, a substantial protection gap persists compared to more mature markets, with per capita insurance density at a modest $283 in Latin America versus $9,250 in the US. Local insurers dominate the market, commanding 64% of total gross written premiums, while global players carve a stronger presence in non-life insurance.

Efficiency emerges as a critical challenge for Latin American insurers, with higher expense ratios than their European counterparts, presenting significant opportunities for operational improvements.

This points to massive opportunities for Insurtech’s to support and enable the current market players, while expanding product portfolios, digitalizing customer interactions, creating new business models, and contributing to closing inequality gaps.

Key Trend — Progression of Open Insurance

A prominent trend in the region revolves around the emergence of open insurance, a novel business approach that advocates for the sharing of open data among organizations spanning various industries. This entails providing open access to information, including terms and prices, with the overarching goal of enabling providers to deliver products and services within digital ecosystems boasting lower operating costs. Simultaneously, this approach aims to enhance efficiency by reaching a broader audience while maintaining effective customer segmentation.

The convergence of Open Insurance and Open Banking gives rise to Open Finance, forming an ecosystem where an individual’s insurance and banking details are unified. This integration facilitates the development of more tailored products and a more assertive and user-friendly transactional experience.

Brazil, in particular, is at the forefront of adopting this model in Latin America. The insurance regulator, Susep (Brazilian Superintendence of Private Insurance), is already in Phase II of implementing a regulatory framework for open insurance. Moreover, since 2017, Susep has been running a ‘regulatory sandbox’ initiative. This program grants licenses to entities, allowing them to experiment with innovative projects for a specified period. During this time, they must adhere to a specific set of regulatory provisions that facilitate the controlled and delimited execution of their activities.

The Latin American Insurtech ecosystem presents a compelling mix of elements that attract global interest and foster growth. While Brazil leads in terms of investment volume, the number of ventures, user potential, and government interest, other countries like Mexico, Colombia and Chile boast similarly mature ecosystems. Brazil accounts for almost 50% of Insurtech investments in the region, followed by Mexico and Colombia. Currently they are around 500 startups focused on building in and around the insurance and Insurtech sector, with a cumulative funding of more than $1 billion (estimated based on various sources).

Life Insurance — A fundamental component for the rising middle class, playing a pivotal role in bridging portions of the existing protection gap

Life insurance serves as a crucial financial tool that provides individuals and their loved ones with a sense of security and stability. Beyond its primary function of offering a financial safety net in the event of the policyholder’s demise, life insurance plays a pivotal role in long-term financial planning. Additionally, life insurance can serve as an investment vehicle, offering opportunities for wealth accumulation and legacy planning. In this way, life insurance goes beyond a mere financial product, becoming a cornerstone for building and preserving financial well-being.

According to MAPFRE’s estimate, in Latin America, the insurance protection gap reached $267.2 billion, with 60% coming from the Life segment.

During the mid-1990s, numerous countries in the region embarked on reforms to their Social Security Laws, resulting in the transfer of life, disability, health, and retirement risks to the open private market. Within the LATAM region, the life insurance market presents considerable opportunities for new business development across three primary segments:

- International Life Products — OffShore: This segment, currently valued at over $2 billion for life business premiums, is experiencing continuous growth propelled by the expanding High Net Worth and upper-middle-class demographics in LATAM. Health business premiums are estimated to surpass $600 million.

- Local Existing Life Market — OnShore: Total premiums for life in the region amount to approximately $80 billion, with about $40 billion attributed to the six target markets (Mexico, Brazil, Colombia, Chile, Argentina, Peru). The historical profitability ratio averages at 19%.

- Insurance Protection Gap: In 2022, the total premiums for the Insurance Protection Gap in LATAM were estimated at around $270 billion across all lines of business. The Life Insurance Gap alone is approximated at $162 billion, representing potential customers who currently lack life insurance but possess the financial means to afford it. These figures underscore the significant opportunities for market penetration and expansion in the LATAM insurance landscape.

Market Tailwinds

Throughout history, insurance penetration in LATAM has maintained a low trajectory, typically hovering at approximately 0.5% to 1.5% GDP for Life insurance. This trend has predominantly been linked to lower incomes, contributing to a limited awareness of the protective advantages that insurance provides. However, a positive transformation is currently unfolding, driven by the growth of the middle class, enhanced accessibility to competitive insurance products, and a generational shift. These factors collectively have spurred an upswing in insurance penetration within the region.

The primary catalysts for the growth of the insurance sector encompass increasing disposable income, enhanced availability of insurance education, a growing demand for financial stability and inclusion, and technological advancements that streamline the insurance purchasing process.

Prominent global reinsurers foresee a 2x increase in insurance penetration across specific countries in LATAM within the next five years. The advantageous impact of the demographic, with 66% of the population falling within the 15–64 age bracket and less than 10% aged over 65, continues to offer significant prospects in the retail consumption business. This encompasses diverse personal lines within the insurance sector, such as individual life and individual health. The emerging middle class in LATAM has witnessed an impressive growth, now representing approximately 30% of total households, underscoring substantial opportunities for insurers to cater to evolving consumer needs and preferences in the LATAM market.

Brokers and agents dominate distribution and remain highly relevant by adapting to client needs.

As indicated by a 2022 survey conducted by McKinsey and LIMRA, although Latin American consumers show a preference for digital interaction, with 67 percent initiating their life insurance search online, the majority of policies are not ultimately purchased through digital channels. When making purchasing decisions, consumers prioritize the security, trust, and convenience associated with in-person interactions.

At AV8, one of the companies in my portfolio is Olé Life, a full-stack digital insurance carrier operating in Latin America. The entrepreneurial team at Ole brings decades of insurance experience, having taken risks in Latin America and acquiring a comprehensive understanding of diverse risk environments. Leveraging their knowledge and expertise, the team has pioneered a novel AI-backed digital underwriting approach for delivering life insurance through online platforms and mobile applications. Olé has excelled in the recruitment, training, and retention of top life insurance agents in LATAM, equipping them with advanced technological tools to enhance their selling capabilities. Headquartered in Miami, Florida, Olé Life stands out as the first fully digital term life insurance product in Latin America that requires no medical exams for policies up to $1 million.

The core of Olé Life’s technology revolves around incorporating data science into its mobile and web applications, providing users with relevant information for a personalized and streamlined purchasing experience. This technology is accessible through embedded quoting engines and APIs, allowing B2B partners and agents to fully utilize and integrate the innovative platform.

As a fact Olé Life focuses on empowering brokers and agents by providing a streamlined, technology-driven approach, enabling them to sell life insurance more efficiently, effortlessly, and at an accelerated pace.

The cutting-edge AI-powered system utilizes data accumulated from decades of policy underwriting in Latin America to approve customers within minutes, offering same-day coverage. Olé Life currently collaborates with A+ rated international reinsurers, including Partner RE, RGA, Munich RE, and has a presence in 30 countries.

Source: Olé Life Management Presentation

Africa — The most underserved insurance market in the world offering vast growth potential coupled with inherent complexity

Dr. Osagyefo Kwame Nkrumah, Ghana’s inaugural prime minister and president, encapsulated a poignant paradox in his impactful declaration:

“It is Africans who are poor but not Africa.”

This statement resonates profoundly, drawing attention to the stark contrast between the continent’s abundant natural wealth and the widespread poverty experienced by its people. Africa’s vast natural resources are undeniable and could contribute significantly to the well-being of its population.

The African insurance market reflects this potential, reaching a substantial US$ 70.2 billion in 2022 according to Swiss Re Sigma Report, with projections indicating growth to US$ 123.8 billion by 2028, at a CAGR of ~8% during 2023–2028. However, despite its size, insurance penetration across Africa remains at a modest 2.8%. The industry’s value of ~$80 billion in Gross Written Premium (GWP) ranks very low globally, with 83% of premiums concentrated in seven key countries (South Africa, Kenya, Egypt, Nigeria, Algeria, Namibia, and Tunisia).

Source: Swiss RE Institute — African Insurance Market

South Africa dominates as the largest market, accounting for ~65% of premiums, ~80% of which are for life insurance.

Source: The Geneva Papers on Risk and Insurance — Issues and Practice — Institutional determinants of insurance penetration in Africa

The significant opportunity lies in the fact that 97% of the continent remains uninsured, offering a vast untapped market. Technology has the potential to bridge this gap, providing affordable insurance as a formal and efficient financial safety net. However, challenges persist, including low demand due to lack of awareness and trust in traditional insurance companies, as well as regulatory inconsistencies among countries, highlighting the need for innovative solutions in the African insurance landscape. Moreover, distribution continues to pose a significant challenge for the industry, with obstacles stemming from various factors, including cultural habits. Beyond addressing distribution issues, another crucial factor is the generation and access to vital data for underwriting and other purposes.

According to World Economic Forum, the insurance sector is leading Africa’s sustainability push.

African nations have embraced a strategy similar to that of Latin American countries through the initiation of ‘regulatory sandbox’ initiatives. However, the outcomes of these initiatives, designed to foster innovation, have generally fallen short of expectations as of today.

In the realms of healthcare and insurance, insiders in the industry suggest that many individuals still prefer to rely on God as the ultimate — or only — physician, or allocate their financial resources to address other needs first. The tendency among Africans is to neglect their health until it becomes an emergency, at which point they start seeking pharmaceuticals and consulting doctors, hindering the necessary innovation.

As per Brighter Bridges, there are more than 70 startups focused on building in and around the insurance and Insurtech sector. Per PitchBook there are more than 100 startups headquartered in Africa, operating across different verticals, from API development to car and crop insurance, with a cumulative funding of approximately $250 million (estimated based on various sources).

Microinsurance — An opportunity within the thriving African ecosystem

Microinsurance has a concise yet influential history, evolving as a mechanism to offer financial protection to low-income individuals traditionally excluded from conventional insurance services. Rooted in the microfinance movement, the concept of microinsurance gained substantial traction in the late 1990s and early 2000s. This momentum can be attributed largely to the groundbreaking efforts of Muhammad Yunus, the Nobel Prize-winning banker and economist from Bangladesh. The microinsurance landscape, therefore, stands as a testament to the extension and impact of the broader microfinance movement.

The International Association of Insurance Supervisors (IAIS) defines microinsurance as “protection of low income people against specific perils in exchange for regular premium payments proportionate to the likelihood and cost of the risk involved.”

Microinsurance plays a crucial role in safeguarding low-income populations through the provision of affordable, basic coverage featuring low premiums and policy sums insured. This form of insurance addresses a vital need in emerging markets where government social safety nets are limited, leaving individuals susceptible to income shocks. However, the global market remains largely untapped, with only approximately 230 million people covered, according to recent estimates. Offerings encompass life, accident, health, property, and agriculture lines specifically tailored to the risks and cash flows of the low-income market. Small farmers for example produce up to 80 percent of the food supply in Africa and Asia and face a 90 percent chance of crop loss due to factors outside of their control, such as pest outbreaks and severe drought.

Source: Amir Kabir — Challenges in Insuring Low-Income Customers

Establishing partnerships with governments, aid agencies, microfinance institutions, and cooperatives is pivotal for microinsurers to reach underserved groups while keeping costs low. Technological innovations, including mobile platforms, user interfaces, and payment systems, contribute to premium growth and enhance financial inclusion. However, profitability remains a challenge due to high distribution costs and low persistency rates. Achieving sustainability hinges on effective claims management and achieving scale. Regulatory development, consumer education, and improvements in product distribution and servicing are essential factors that can significantly expand microinsurance markets.

Source: Micro Insurance Network — The Landscape of Microinsurance 2022

Startups building in that space for example are Pula Advisors, an agricultural insurance and tech company that designs and delivers innovative agricultural insurance and digital products to help smallholder farmers endure yield risks, improve their farming practices, and bolster their incomes over time. Pula Advisors, which works across Africa and Asia, has insured more than 15 million farmers so far, and surpassed US$80 million in gross premiums.

Others like Jamii.one operate a digital finance platform intended to transform data into financial opportunities. Jamii’s platform also provides affordable and accessible micro-insurance products to low-income individuals and communities in Ethiopia. The company’s products include crop, livestock, life and health insurance.

OKO brings affordable crop insurance to underserved smallholder farmers, giving them access to the finance that keeps them sustainable and allows them to grow. As of July 2022, OKO has insured more than 18,500 farmers, making OKO the most popular crop insurance product in the country.

Turaco is pioneering microinsurance solutions to make insurance accessible for those living on less than $5 a day. The company offers affordable life and accident coverage, priced at an average of $2 per policy, specifically designed for urban and rural populations. In its first year, Turaco insured more than 40,000 customers, providing peace of mind and coverage in times of greatest need. Since 2019, Turaco has delivered customised policies covering over 1.3 million Africans.

Middle East & North Africa (MENA) — The region with the lowest insurance penetration

The insurance penetration in the Middle East and North Africa (MENA) region is the lowest globally, with less than 1% market penetration for insurance companies. This can primarily be attributed to fragmented market structures, lack of awareness, cultural and religious beliefs in the region that play a significant role in the low insurance penetration rates. Furthermore, impediments to market growth include competitive distribution strategies and a scarcity of talent possessing extensive insurance experience. The primary lessons derived from the initial wave of Insurtech’s in the US, as highlighted in Part II, emphasize that technology alone is not a winning factor; a solid understanding of insurance fundamentals is paramount. Notably, the aggregation model has emerged as the driving force behind Insurtech growth, earning recognition from regulators throughout the region. This underscores the observation that the MENA region is still in the early stages of the insurance innovation cycle, mirroring the efforts discussed in Part I regarding the US market.

The markets of Saudi Arabia, the United Arab Emirates, Kuwait, and Qatar represent the biggest insurance markets in the Gulf Cooperation Council (GCC) region. Non-life insurances are the more significant segment of the insurance industry in this region. Most insurance policies have been adjusted to Islamic law requirements, in the same way as other financial products, to avoid interest-related income.

Source: Swiss RE Institute — Emerging Middle East Insurance Market

Determining the comprehensive market size of insurance in the Middle East poses a challenge. However, according to Swiss Re’s 2022 report, the insurance market for the Emerging Middle East region (United Arab Emirates, Saudi Arabia, Iran, Iraq, Bahrain, Jordan, Kuwait, Lebanon, Oman, Pakistan, Qatar, Yemen, Syria) amounted to approximately $43 billion. This amount is divided into 83% for non-life insurance and 17% for life insurance. Considering Morocco (~$3B), Egypt ($3.5B), Algeria ($1.5B), Israel ($11.5B) and Tunisia ($1B), the collective market size for insurance in the MENA region approximates $64 billion.

According to Alpen Capital, the GCC insurance market (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and United Arab Emirates) is projected to grow at a CAGR of 5.3% from $34.3 billion in 2023 to $44.4 billion in 2028. The non-life insurance segment is anticipated to grow at a CAGR of 5.4% between 2023 and 2028 reaching US$ 39.6 billion, comprising 89.2% of the region’s GWP by 2028. However, the GCC insurance market is fragmented and highly competitive. Price competition to secure business in the fiercely competitive motor and medical insurance segments threaten the profit margin of insurers.

Furthermore, the complexity level varies across different insurance segments and regions; for instance, health insurance is highly regulated, while motor insurance has become a prominent focus in MENA due to its growing significance. Health and motor insurance together constitute the majority of written premiums collected by insurance companies in the region.

Source: Best’s Review— February 2024 Edition

In the UAE, which has over 550,000 SMEs, and Abu Dhabi, health insurance is mandatory for its residents and all employers must provide health insurance to employees and their dependents. However, Abu Dhabi and Dubai are the only two emirates of the UAE that have mandatory health insurance laws. Another interesting fact is that motor insurance in Qatar insures the vehicle rather than the driver. Therefore, once a vehicle is insured, anyone with a driving license can drive it.

According to CBInsights there are around 70 companies transforming Insurtech in the Middle East and North Africa. Per PitchBook there are 60 startups headquartered in MENA (excluding Israel), operating across different verticals, with a cumulative funding of approximately $200 million (estimated based on various sources and excluding Israel). Startups such as Dubai-based Yallacompare let consumers compare and buy insurance policies — including auto, life, health, pet, and travel — in 9 markets in the region. Others like Democrance, have a mission to enable partnerships that make insurance accessible and affordable for those who need it most.

The ascent of Takaful as a solution influenced by cultural factors

Access to insurance is further restricted in most countries with sizeable Muslim population as people remain reluctant to buy insurance due to socio-cultural and religious reasons. In general, the conventional insurance mechanism involves elements that are prohibited by Islamic rules and principles.

Takaful is an Arabic word that means assuring each other.

Takaful, as an Islamic insurance concept, resonates with the Islamic heritage of the Middle East, making it a natural choice for individuals seeking insurance without compromising their faith. This cultural and religious alignment has contributed to the remarkable growth of Takaful in the region in recent years. The global Takaful insurance market was valued at $31.7 billion in 2022, and is projected to reach $126.8 billion by 2032, growing at a CAGR of 15.2% from 2023 to 2032. Saudi Arabia remains the largest Takaful market in the GCC with overall GWP of US$ 14.2 billion in 2022.

Takaful and conventional insurance exhibit certain differences. Takaful operates on principles of mutual collaboration, solidarity, and indemnification, where participants protect each other from potential losses or catastrophes by sharing the financial burden. In contrast, conventional insurance involves the transfer of risk from the insured individual to the insurer firm.

Source: The Actuary — Takaful’ models of Islamic insurance

Takaful companies invest in Sharia-compliant instruments, promoting ethical financial practices and alignment with Islamic teachings. Additionally, Takaful’s customization process takes into account the cultural values and beliefs of the target communities, ensuring that the products are not only financially effective but also culturally sensitive. Furthermore, Takaful’s emphasis on community solidarity is well-suited to addressing complex, cross-border challenges, reflecting its cultural adaptability and resilience.

Among the 20 countries that contribute to 90% of the world’s insurance premiums, none are recognized for having significant Takaful market share, and the majority lack notable availability of Takaful products.

It is crucial to emphasize that Takaful is not limited exclusively to Muslims.

It is fascinating to see that such an old model of peer-to-peer insurance has strong relevance today within a society with the lowest insurance penetration.

How Incumbents are leading change with Insurtech

Within the GCC countries, the United Arab Emirates (UAE) and Saudi Arabia stand out as primary hubs for Insurtech innovation. Their robust economies, expanding middle class, and favorable regulatory landscapes make them appealing investment destinations for Insurtech startups.

Saudi Arabia has probably the most developed frameworks as part of its efforts to push insurance forward. The Insurance Authority in Saudi Arabia aims to regulate, supervise and control the insurance sector and provides specific guidelines and rules — here are the guidelines and rules for licensing and supervising Insurtech companies operating in the insurance sector. An interesting highlight is that Insurtechs must have a physical presence in Saudi Arabia and employ Saudi nationals.

In the UAE, Dubai, in particular, has positioned itself as an innovation hub, drawing in a diverse array of startups. It encourages collaborations among Insurtech firms, regulators, and traditional insurance providers. The Dubai International Financial Centre (DIFC) has initiated several programs, such as an innovation hub and accelerator, to nurture Insurtech startups and aid in their development.

Established players have been actively engaging in partnerships with Insurtech startups to cater to their clients. A notable instance is Sukoon Insurance, a prominent multi-award-winning provider of health, travel, and car insurance in the UAE. Founded in 1975 and majority-owned by Mashreq Bank, Sukoon stands as one of the largest publicly listed insurers in the country. Renowned for innovation, it serves over 800,000 customers and offers various digital solutions, including mobile apps, online quoting, and portals for existing clients, as well as its network of agents and brokers. Recently the company entered into a strategic partnership with WAX, one of my portfolio companies here at AV8, to launch the first collector App in the UAE.

Another example is XA’s Group roll out of a Blockchain-based motor insurance platform. The platform facilitates insurance companies in reconciling motor recovery receivables and streamlining the claims recovery process.

The GCC’s emphasis on digitalization opens doors for Insurtech startups to revolutionize the insurance sector through technology, data, and customer-centric strategies. Insurtech facilitates the creation of tailored products by insurers to meet individual needs, contributing to a heightened demand for insurance.

In Part IV of Insurtech and the ongoing expansion of the E&S insurance market, I will cover the opportunities within the E&S sector and how Insurtech’s are playing a pivotal role. Whether you have valuable Insurtech insights or wish to be part of the conversation, feel free to reach out at amir@av8.vc or via Twitter at @AmirKabir99.

Amir is a General Partner at AV8 Ventures where he leads Fintech and Insurtech investing and has been one of the earliest investors in the Insurtech space. https://av8.vc/amir-kabir/

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future. (I have copied the disclaimer used by Jamin Ball in his great newsletter Clouded Judgment)

0 Comments